Apni Zameen Apna Ghar: Security After Loan Approval

The Apni Zameen Apna Ghar scheme helps people own their own homes easily. It gives support through simple loans and special benefits for widows, disabled citizens, and government workers. After getting loan approval, it is important to protect your property legally and financially. Keeping documents safe, paying installments on time, and staying in touch with authorities ensures full security. This scheme makes home ownership safe, affordable, and worry-free for families in Pakistan.

Read more: Step by Step Guide to Applying 3 Marla Plot

اپنی زمین اپنا گھر اسکیم لوگوں کو آسانی سے اپنے گھر حاصل کرنے میں مدد کرتی ہے۔ یہ سادہ قرضوں اور بیواؤں، معذور شہریوں اور سرکاری کارکنوں کے لیے خصوصی فوائد کے ذریعے مدد فراہم کرتا ہے۔ قرض کی منظوری حاصل کرنے کے بعد، قانونی اور مالی طور پر اپنی جائیداد کی حفاظت کرنا ضروری ہے۔ دستاویزات کو محفوظ رکھنا، قسطوں کی بروقت ادائیگی، اور حکام کے ساتھ رابطے میں رہنا مکمل تحفظ کو یقینی بناتا ہے۔ یہ اسکیم پاکستان میں خاندانوں کے لیے گھر کی ملکیت کو محفوظ، سستی، اور فکر سے پاک بناتی ہے۔

Background of the Scheme:

The Apni Zameen Apna Ghar scheme was started to help low and middle-income families own homes. It offers easy loans and support, with special preference for widows, disabled persons, and government employees.

Understanding Loan Approval:

Steps to Get a Loan Approval:

- Apply for the loan through the housing office.

- The team will check your papers and details.

- You’ll get a message or letter once your loan is approved.

Required Documents:

- CNIC or national ID.

- Proof of income.

- Bank statements.

- Any other documents requested by the authority.

Eligibility for Loan Approval:

- Must be a Pakistani citizen with a valid CNIC.

- Should have a steady source of income.

- Must fall within the set income limits.

- Special quota available for widows.

- Reserved seats for disabled persons.

- Preference also given to government employees.

Importance of Post-Approval Security:

-

Protecting Your Investment:

After loan approval, proper steps help keep both your money and property secure

-

Legal Ownership:

Keep your ownership papers complete and registered to avoid disputes.

Avoiding Fraud:

Rely only on official processes to stay safe from scams or fake agents.

Benefits of Post-Approval Security:

- Secures your property and money.

- Confirms legal ownership.

- Saves you from fraud or misuse.

- Makes selling or transferring easier.

- Helps property value grow over time.

Measures for Security After Approval

Property Registration:

- Register your property with the concerned authority.

- Keep an extra copy of the registration papers for record

- Get the allotment letter from the housing scheme and store it safely.

- Store the allotment letter safely for future use.

- Ensure you have the allotment letter from the housing scheme.

- Keep it safe for future reference.

Bank Safeguards & Loan Insurance:

- Make sure the bank follows proper procedures.

- Use insurance options to protect against unexpected events.

Payment Record-Keeping:

- Maintain records of every installment payment.

- Use bank receipts or online transaction proofs.

Tips for Loan Recipients:

- Stay in regular contact with the housing authority.

- Pay installments on time to avoid cancellation.

- Monitor property construction or development progress.

- Verify any updates or changes officially.

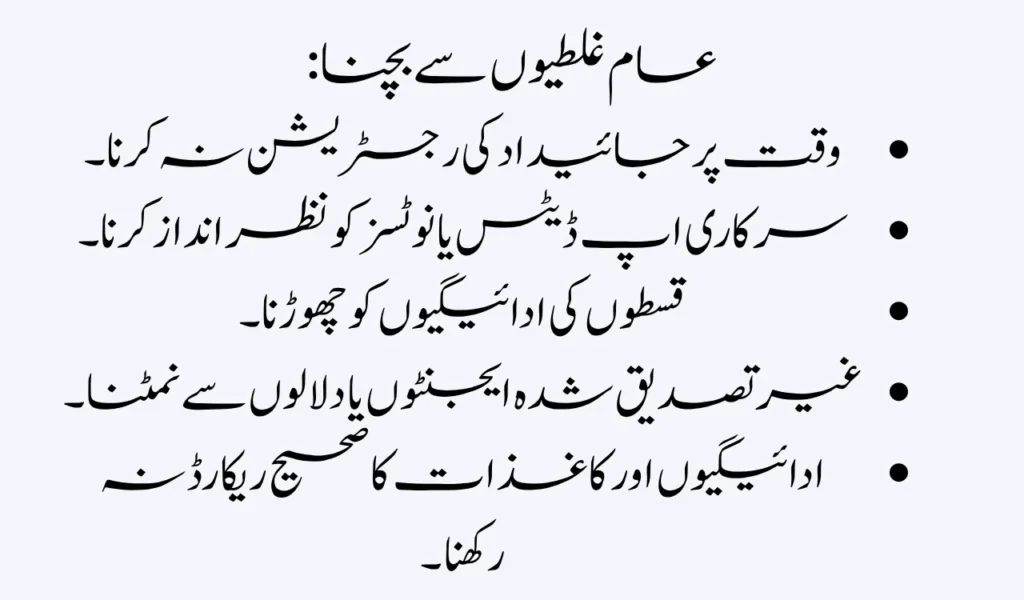

Common Mistakes to Avoid:

- Not registering the property on time.

- Ignoring official updates or notices.

- Skipping installment payments.

- Dealing with unverified agents or middlemen.

- Not keeping proper records of payments and papers.

Role of Government and Developers:

Secure Handover of Plots/Houses:

The government and developers make sure plots and houses are handed over correctly and safely.

Support for Dispute Resolution:

Authorities offer ways to resolve complaints or problems related to your property.

Conclusion:

After loan approval, taking the right steps keeps your property safe and secure. Keeping documents and payments in order and staying connected with authorities helps avoid problems and ensures a smooth home ownership experience.

FAQ’s:

Who provides support in case of disputes?

In case of any issue, the government and developers offer proper channels to handle complaints and property matters.

What is the Apni Zameen Apna Ghar scheme?

It is a government scheme that supports families in getting their own houses through easy loans and financial help.

Why is post-loan security important?

It keeps your money protected, your ownership clear, and prevents fraud.