Save Money with CM Kisan Card – Low Interest Rates

Most farmers know the pain of borrowing money at crazy high rates. You take a loan to buy seeds, and half your harvest goes to paying interest. The CM Kisan Card changes that game completely. With rates starting at just 8%, you’re not bleeding money anymore. Plus, there’s no need to risk your land as collateral or worry about surprise charges that pop up later.

Read more: Benefits of Punjab Kissan Card for Small Landholders

زیادہ تر کسان اعلیٰ نرخوں پر قرض لینے کے درد کو جانتے ہیں۔ آپ بیج خریدنے کے لیے قرض لیتے ہیں، اور آپ کی آدھی فصل سود کی ادائیگی میں جاتی ہے۔ سی ایم کسان کارڈ اس گیم کو مکمل طور پر بدل دیتا ہے۔ صرف 8% سے شروع ہونے والی شرحوں کے ساتھ، آپ کو اب پیسے نہیں بہہ رہے ہیں۔ اس کے علاوہ، آپ کی زمین کو ضمانت کے طور پر خطرے میں ڈالنے یا بعد میں ظاہر ہونے والے حیرت انگیز چارجز کے بارے میں فکر کرنے کی ضرورت نہیں ہے۔

Understanding CM Kisan Card Interest Rates:

- CM Kisan Card offers 8%–12% interest, lower than normal loans.

- Interest is calculated on actual usage, not credit limits.

- Seasonal payments match harvest cycles, easing pressure.

- No hidden charges or extra processing fees.

- Fixed rates protect farmers from market changes.

Comparing Costs: CM Kisan Card vs Traditional Loans:

- Traditional agricultural loans often charge 15-20% interest, almost double the CM Kisan Card rates.

- Private lenders and commission agents can demand 30-40% interest, creating debt cycles.

- Bank loans require extensive documentation and collateral, adding indirect costs.

- The CM Kisan Card eliminates middleman commissions that drain 10-15% of loan amounts.

- Processing times are reduced from weeks to days, preventing crop timing losses.

Flexible Repayment Options That Save Money:

- Farmers choose repayment schedules matching their crop cycles and income patterns.

- Grace periods during sowing seasons prevent default penalties and credit score damage.

- Early repayment options allow farmers to close loans after harvest without penalties.

- Partial payment facilities help manage cash flow during unexpected expenses.

- Rescheduling options during natural disasters or crop failures protect long-term creditworthiness.

No Collateral Requirements Reduce Indirect Costs:

- Unlike traditional loans, the CM Kisan Card doesn’t require land documentation or property papers.

- Eliminates legal fees, stamp duties, and registration costs associated with collateral.

- Farmers avoid valuation charges that can add 2-5% to total borrowing costs.

- No risk of losing land or assets in case of temporary financial difficulties.

- Simplified documentation reduces time and transportation expenses for multiple bank visits.

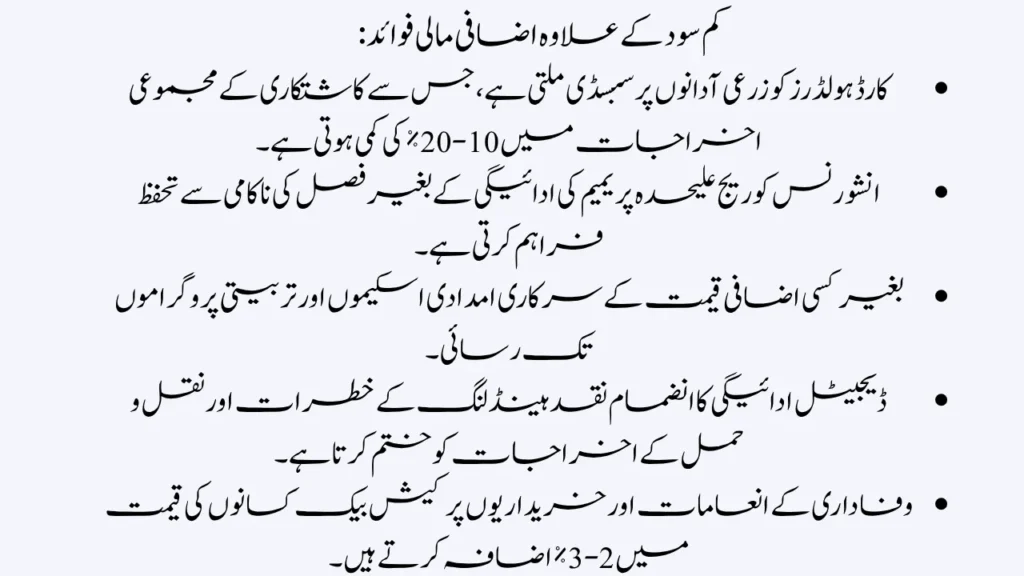

Additional Financial Benefits Beyond Low Interest:

- Cardholders receive subsidies on agricultural inputs, reducing overall farming costs by 10-20%.

- Insurance coverage protects against crop failures without separate premium payments.

- Access to government support schemes and training programs at no additional cost.

- Digital payment integration eliminates cash handling risks and transportation expenses.

- Loyalty rewards and cashback on purchases add 2-3% value back to farmers.

Long-term Wealth Building Through Smart Borrowing:

- Lower interest rates free up capital for investment in high-yield crops and modern techniques.

- Consistent repayment history builds credit scores, unlocking better financial opportunities.

- Reduced debt burden allows farmers to save for children’s education and family needs.

- Access to larger credit limits over time supports business expansion without rate increases.

- Financial literacy programs included with the card help optimize resource allocation.

How to Maximize Savings with Your CM Kisan Card:

- Borrow only what you need and avoid utilizing the full credit limit unnecessarily.

- Time your borrowing with seasonal crop cycles to minimize interest accumulation.

- Maintain regular communication with agricultural officers for financial guidance.

- Combine card benefits with government subsidy programs for maximum cost reduction.

- Keep detailed records of expenses and returns to optimize future borrowing decisions.

Real Success Stories: Money Saved by Farmers:

- Abdul Rehman from Punjab saved PKR 45,000 annually switching from private lenders to CM Kisan Card.

- Fatima Bibi increased her net income by 30% after eliminating high-interest middleman loans.

- A farmers’ cooperative in Sindh collectively saved PKR 2 million in the first year of card adoption.

- Small landholders report 20-25% improvement in household savings after card implementation.

- Young farmers are investing saved money into mechanization and modern irrigation systems.

Conclusion:

The CM Kisan Card gives farmers a real chance to break free from expensive loans. With lower interest rates and no collateral needed, families can save thousands each year. This extra money helps improve farms and support children’s education. The card proves that when credit becomes affordable, entire communities grow stronger together.

FAQ’s:

Are there any hidden charges or fees?

There are no extra fees, processing charges, or penalties for paying early.

Is collateral required for the CM Kisan Card?

No, you don’t need to put up land or property to get the card.

How do seasonal repayment options work?

You pay back the loan after harvest when you actually have money coming in.